Accounting Time and Billing Software: Is Your Firm Afraid of Change?

Why You Shouldn’t Be Afraid to Change Your Time and Billing Software

Recently, one of our long-standing clients agreed to update to the newer version of our time and billing software. Prior to installation we conversed about what the new version included. The client wanted assurances that the newer version “will function in basically the same way”. After twenty years in the software business, I understand the valid concern regarding software updates. Experience has shown that buggy or ill-conceived updates have the potential to wreak havoc on daily operations.

The Inmates are Running the Asylum

The Inmates Are Running the Asylum, published in 1999, uses the author’s experiences in corporate America to illustrate how talented people continuously design bad software-based products and why we need technology to work the way average people think. I often wonder how talented computer programmers can write good application software for particular industries without direct work experience. Software products should provide users an experience based on their perception of how software should serve their business needs.

As a result, many accounting firms are reluctant to change fearing lost time and profits that could result when new software fails to implement properly. To that end, many CPA and accounting firms still use spreadsheets or old “DOS” based programs to perform important time and billing software functions. Others use Quickbooks® to track and bill time. Although these products attempt to accomplish the needed result, the process used is not the most efficient or effective. Consequently, it often costs your firm extra time and effort as well as reduced billings.

Effective Time and Billing Software

Effective time and billing involves multiple tables linked in a relational database. Spreadsheets are one-dimensional whereas relational databases implement a one-to-many relationship. For example, work code descriptions need not be redundantly stored within each time slip – instead a link to the work code record is saved in the time slip record. This saves time, space and improves data management. All these features are ‘under the hood’ and not necessarily revealed directly to the user.

Does the Software Shoe Still Fit?

Older “DOS” and Windows-based databases such as “Unilink Dos” implemented database relationships and were great programs when first released. By today’s standards, however, these programs are obsolete relics and limit your firm’s ability to compete. First generation time and billing products lack the horsepower to generate sophisticated performance reports and are unable to provide sufficient historical information to generate reports for prior periods. Required period closings limit what can be viewed from prior periods and errors or mistakes oftentimes often cannot be reversed.

Quickbooks® is a great accounting product that can track time, but lacks the ability to generate detailed work in progress reports that itemize and summarize the value of your unbilled inventory. You never know the total value of your work in progress in relation to revenue or billed receivables – a significant asset to overlook! Historical realization reports are also unavailable.

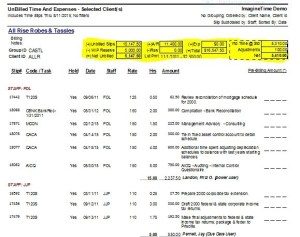

Please review the snippet of a comprehensive work in progress report in the following graphic:

When CPAs are Comfortable with Current Practices

CPAs and accountants have a reputation for being slow adopters when it comes to change and technology. To paraphrase a 2011 article on change by Julie Rains, Senior Writer – Freelance, Killer Aces Media – there are five reasons not to embrace change:

- Productivity will plummet and stress will skyrocket. The simplicity of day-to-day tasks is comforting. We take comfort in following a self-developed decision tree with a limited number of variables.

- Embracing change means admitting past mistakes– admitting that past procedures caused errors or less than optimum results opens the way for improvement and better practices.

- Failures are not occasions for learning – navigating change is like falling into an abyss rather than interpreting clues on a hidden-treasure map. In other words, learn from our mistakes. Don’t expect different results from repeating the same procedures.

- Difficult problems arise from change– the side effects of change may involve handling situations that we do not fully understand.

- Unwillingness to risk status among colleagues and employees….how long can we stay relevant by preserving the status quo?

Julie Rains suggests that in order to successfully embrace change we must establish a new performance metric when change occurs. “Emphasize the need for continual renewal, not as an indictment of the past, but as a strategy for ongoing success”. When making a change we must “identify known negatives that will likely surface as byproducts of change. Next, we must anticipate the best practices for dealing with these situations”.

The 1973 Texas Instruments Calculator

As a former practicing accountant of 25 years, I frequently experienced great resistance to change among my colleagues. During my apprenticeship at J.K. Lasser & Company in Miami, the audit staff would request lengthy amortization schedules from the IT department mainframe in order to analyze notes payable during the course of an audit. I recall being ridiculed for using a Texas Instruments calculator to verify note balances with a few button presses.

In college, I learned formulas for determining present values and level payment amounts which I carried in my wallet. I was able to use them with this “fantastic” new device. The calculator determined the present value of future payment streams at any given interest rate – no amortization schedule required! The results displayed on the screen in bright red. Later, a small tape printout allowed the attachment of the results to our work papers. Today, we use Microsoft Excel to do these calculations and print out the spreadsheet.

In Conclusion – “If it Ain’t Broke, Don’t Fix It”?

At Mango, we speak to many firms that currently use spreadsheets, older “DOS” programs or QuickBooks® and are looking for a better solution…as long as it doesn’t involve too much change. These calls usually occur when the program has crashed and owners are desperate. It’s best to change before things reach this point. Your firm should reach a consensus about your future goals and move forward discarding the relics of the past. You can teach an old dog new tricks!

Blog Categories

Recent Articles

Accountants: How to Stop Leaving Money on the Table

One big challenge that accountants, medical practitioners, lawyers, and all independent contractors…

The Pros and Cons of Integrated Payments

In this post, we discuss why you should use an integrated payments system at your accounting firm, along with three considerations to keep in mind.

How To Increase Your Realization Rate

In this guide for accountants, we discuss what is a realization rate, and how you can use this metric to improve your firm’s profitability.

Your Website is Costing You Business

Your website serves as the front door to your accounting firm. If…

How Accountants Can Avoid Burnout During Tax Season

Welcome to your survival guide for the tax season. For accounting professionals,…