CPA Performance Accountability: Who’s Responsible for Mistakes?

The Importance of Practice Management and Staff Accountability for CPA and Accounting Firms

While there are many ways to “successfully” manage your firm, managing your firm for optimal performance is not easy. Practice management and staff accountability go hand-in-hand. One of the most fundamental steps toward optimal performance is to establish a culture of honesty and transparency. In such a culture, established staff performance goals are embraced because staff understands the expectations and trusts that performance assessments will be fact-based and objective.

Performance assessments include some very basic metrics such as:

- Quantity of work hours, both chargeable and non-chargeable

- Efficiency of work

- Ability to generate clients

- Ability to work as a team member

It is important to have reporting mechanisms that quantify these goals and allow you to objectively measure performance at periodic intervals. At the same time, you must also evaluate these reports in the context of the firm culture using common sense, honesty and realistic expectations. These intangibles are not taught in college or tested for on the CPA exam but derive from your native instincts and the school of hard knocks.

Practice Management and Staff Accountability – the Old-Fashioned Way

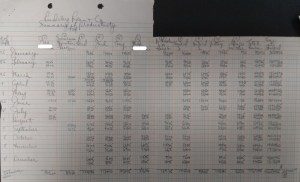

In the early days – before computers – our CPA firm spent hours tabulating staff productivity on thirteen column spreadsheets like the example shown below for 1984:

Computer software has made it possible for many firms today to measure staff efficiency by comparing chargeable time to billed realization – a next to impossible task if performed manually. If you click to enlarge the sample report below, you will see the areas where this employee works most efficiently, with the highest hourly rate and lowest fee adjustments and accordingly, the best realization. You will also see the amount of time spent on non-chargeable activities.

Practice Management and Staff Accountability – How Far We’ve Come

Popular time and billing software products have reports similar to this one generated with Mango software. Most also have reports that breakdown the metrics by client and show staff contribution to firm gross revenues by year along with information about staff salary and costs. This allows firms to develop cost multipliers, 2, 3, 4 times cost, etc. It also helps determine whether that ratio is improving or deteriorating over time.

Reports similar to this should be implemented and relied upon. But as mentioned previously, it is important to evaluate performance reports in the context of the firm’s management culture.

One of my first jobs out of college was working for a “Big 8” accounting firm. Staff was expected to generate at least 2,000 chargeable hours a year, continue professional education and assist in practice development. I was given responsibility as a “semi-senior” during the annual audit of a local governmental port authority. Enterprise fund accounting was new to me at the time. It was interesting to have the opportunity to implement the fund accounting methods learned while attending school.

During the audit, however, it became increasingly clear to me that the prior financial statement presentation of fund accounting was significantly incorrect. It also became clear that the amount of time needed to properly research and correct the issue was not allocated in the in the fixed-fee budget.

Practice Management and Staff Accountability – Reporting and Transparency

I received little support when I informed the partner about the problems with the financial presentation in prior years. In addition, the manager was disturbed about supervising a job that wouldn’t be brought in under budget. The partner was not forthcoming and seemed irritated. In hindsight, I can see that he was probably embarrassed that the presentation was botched the prior year. My professional pride persuaded me to correct the statements on my own time. I didn’t record all the time I spent doing performing the additional work, even though I was told I should. Staff that ran over budget didn’t last long. That was the clear message. The firm’s culture of fear trumped any attempt at transparency and honesty. After a few years, I moved on to open my own firm.

Truth is, this client either should have been let go or should have been paying for the resources they consumed. But, the firm was unwilling to confront that reality. Truth be told, my fear of retaliation kept my time reports from revealing the true cost of servicing this client. Performance reporting tools reflect the quality of the data provided, and that input depends on the culture of the firm.

Latest Posts

On the Edge of Efficiency: Inside the 2026 AI in Accounting Report

he 2026 AI in accounting report is here. Get key takeaways on adoption rates, strategic use cases (beyond LLMs), and how firms are managing risks to client trust.

4 Ways AI Document Management Software for Accountants Stops Doc Chaos

Learn how AI-powered document management software transforms accounting workflows, eliminating chaos, saving time, boosting efficiency, and ensuring compliance for your firm.

How Client Advisory Services Make You Indispensable

Client advisory services (CAS) blend accounting with strategic guidance to help clients grow. Learn how CAS can increase firm value, revenue, and loyalty.

How to Measure Firm Productivity After Tax Season: The Importance of Post Tax Season Assessments

Post-tax season assessments help firms improve productivity, streamline workflows, and prepare for the next tax season. Learn what to measure and how to act on it.

10 Hilarious Accounting Memes to Beat Tax Season Burnout

Tax season: that magical time of year when coffee becomes a food…